The Difference between Payday Loans and Bank Loans

Lending money is a tricky business. It can be profitable, but risky for the lender if the borrower doesn’t pay back the loan on time. Lenders want two things: to make sure they get their money back and to make some profit off of it in the meantime

Bank loans are one-way lenders can take both steps at once. But what about payday loans? What’s the difference between bank loans and payday loans? Payday loans and bank loans are two different types of financial products with a few distinctions.

A bank loan is a type of loan where the borrower receives money from a financial institution, often a bank, to finance a major purchase. Bank loans usually have fixed interest rates and fixed repayment terms, making them a more stable option than some other types of loans.

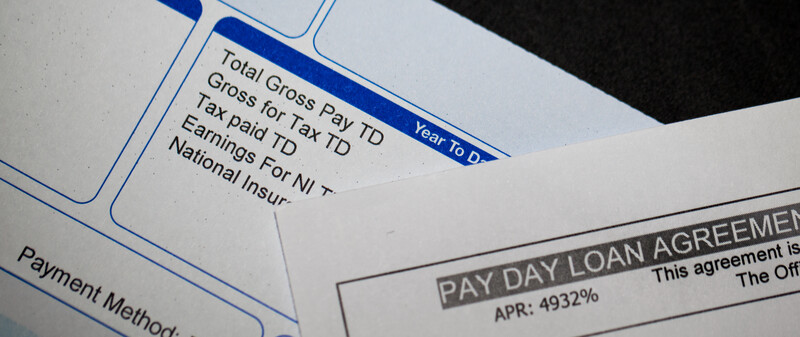

A payday loan is a type of short-term loan, typically due to being repaid on the borrower’s next payday. Payday loans are often available to people who have bad credit or who do not have access to other forms of credit.

A comparison of Payday Loans and Bank Loans

Bank loans have lower interest rates than payday loans, but also require more commitment from you as a borrower – often with payment plans that extend for months or years into the future. Payday Loans are short-term payments that must be repaid on your next paycheck – usually within just a few weeks.

Bank loans are also different from payday loans in another important way: they come with plans for your repayment, which might include a combination of bi-weekly payments and monthly instalments. This may make it easier for you to manage your debt as you pay back the loan.

However, the big difference between bank loans and payday loans is that bank loans tend to be much more affordable and give you the chance to pay back the loan over a longer period of time. You can also get financial help from banks, like low-interest rates or no closing costs.

Why bank loans are more affordable than payday loans?

Payday lending is an expensive form of borrowing money because it charges high fees for every dollar borrowed (often as much as $15 per $100). When you take out this type of loan, you should only use it to cover unexpected expenses like car repairs or medical emergencies, not everyday living costs like groceries or rent. And keep in mind that these days many credit cards charge around 25% APR. Additionally, credit card companies usually give you months to pay off even the biggest balances.

While payday loans seem straightforward and easy to get, they can become a long-term financial problem if you continually roll over your debt or take out new loans before paying off old ones. The average borrower ends up indebted for almost 200 days and pays around $520 in finance charges to repeatedly borrow $375.

This is why it’s important not to take out a payday loan unless absolutely necessary because these small loans can become a means to sustain you financially for an extended period of time. If you still need cash and want to avoid the high fees, try asking your family or friends if they’ll lend you the money. Or you could save up for emergencies by stashing away your cash in an emergency fund, like a high-yield Savings account.

You may wonder whether payday loans are legal and if people really get sued for not paying these types of loans back. The truth is that there have been plenty of huge class-action lawsuits filed against payday lenders. In fact, in some cases, the lawsuits have been successful and payday lenders were forced to reimburse their customers with a portion of their loan fees.

More recently, a number of states have passed laws that limit or prohibit payday lending companies from charging high-interest rates on loans. Many states also require lenders to be upfront about the interest rates they charge.

What Do You Need To Consider Before Choosing The Loan?

When choosing a loan, it’s important to think about what’s best for your financial situation. Bank loans offer lower interest rates and longer repayment terms than payday loans, but they may not be available to everyone. Payday loans, on the other hand, are more readily available but come with much higher interest rates.

Before taking out any type of loan, it’s important to make sure you can afford to repay it in full and on time. You should also consider how the loan will affect your monthly budget and whether you’ll be able to meet your other financial obligations.

Payday Loans and Bank loans are different in many ways, but it is important to note that both can be used for borrowing money. The key difference between the two types of loans is their terms and interest rates: bank loans offer lower interest rates with longer repayment periods than payday loans do. Payday loan companies often charge high fees on payments, so these should only be taken out when absolutely necessary (e.g., car repairs). If you need money quickly or don’t have a lot of cash saved up for emergencies, then taking out a short-term loan may work well for your financial situation – just make sure you can afford to repay it in full by your next payday!